Content

This can be calculated by taking the projected sales for the period and subtracting any returns, discounts, or allowances that are expected. The next step is to calculate Apple’s gross profit budgeted operating income formula by subtracting its cost of sales from its net sales, which comes out to $170,782 million. The operating income metric is important since it only measures the core profitability of a company.

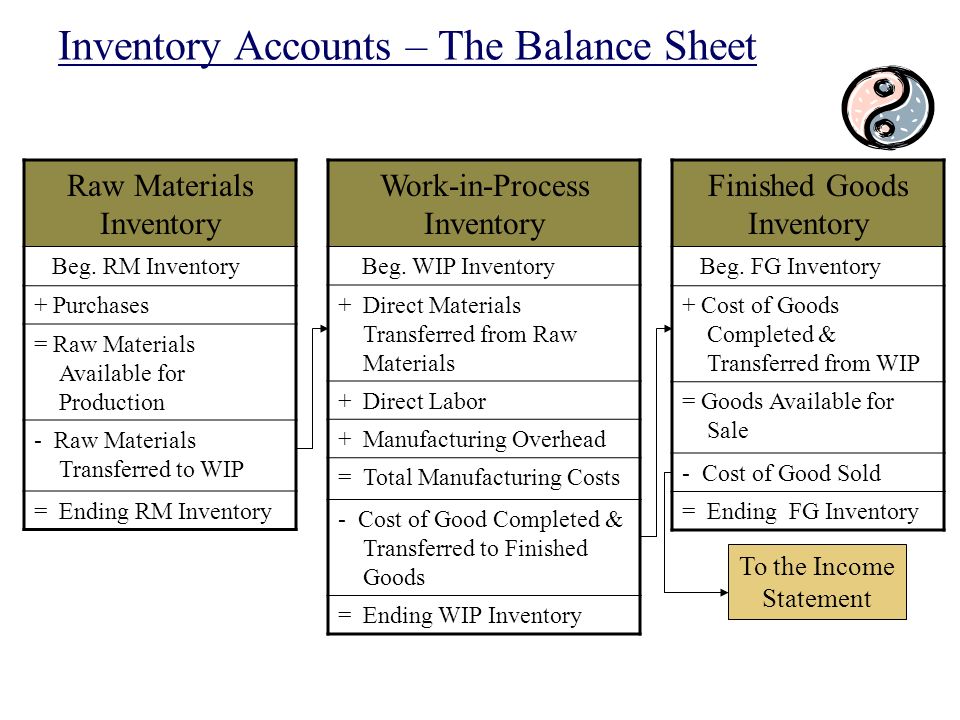

In the manufacturing overhead budgeting process, producers will typically allocate overhead costs depending upon their cost behavior production characteristics, which are generally classified as either variable or fixed. Based on this allocation process, the variable component will be treated as occurring proportionately in relation to budgeted activity, while the fixed component will be treated as remaining constant. This process is similar to the overhead allocation process you learned in studying product, process, or activity-based costing.

Format of Budgeted Income Statement

For example, you can break down your administrative, selling, operating, and general expenses in the expenses section of your income statement. It’s critical to document and include these expenses so your net income calculations are accurate. Operating income, operating profit, and earnings before interest and taxes are all terms that relate to the earnings of a business.

- Next, selling and administrative expenses are subtracted from the gross margin to arrive at the company’s operating income.

- While becoming profitable in your first year of business is challenging, if you are profitable, it’s a positive indicator that your company is heading in the right direction.

- If changes in market conditions affect any of the variables involved, revisit your estimates and calculate a new operating-income expectation to keep your budget planning efforts as relevant and informed as possible.

Discuss how the calculation of the coefficient of variation can be applied in budget variance analysis and what budget models is the application best applied. Understand what budget variance is, identify what constitutes positive budget variance, and learn how to calculate budget variance. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. And setting departmental and functional goals, the success of it to a large extent depends on effective execution at all levels.

Best Practices to Increase Net Operating Income

Neither will come as a surprise, as you need to change up cash flow either in or out of your business to affect your profit margins. Operating profit is a company’s earnings after deducting operating expenses and Cost of Goods Sold . One EBIT limitation is that it doesn’t account for depreciation and amortization.

It will show you what’s working and what isn’t, and what you can do about it.Creating a useful business budget takes careful forward planning and a sober approach to business growth. One way to do this is to lay out the process in a series of steps.In this blog post, we’ll take you through the business budget in full. We’ll explain what it is and why it’s important, before we lay out the components of any complete business budget. Then, we’ll outline the six necessary steps towards business budget creation. This figure represents your total sales for the period by revenue type. This line could also be known as Net Revenue/Sales, which takes into account sales returns, allowances and discounts.

Join 41,000+ Fellow Sales Professionals

The company will expense $800 each year until the machine is completely paid off in the 10th year. Depreciation involves expensing of tangible assets over their useful life. Tangible assets, or fixed assets, are physical assets such as buildings, vehicles, equipment, office furniture, etc. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Before creating the budgeted income statement, you’ll need to have created all the other operating budgets like the direct materials, direct labor, manufacturing overhead, and administrative expense budget. Operating income—also called income from operations—takes a company’s gross income, which is equivalent to total revenue minus COGS, and subtracts all operating expenses. A business’s operating expenses are costs incurred from normal operating activities and include items such as office supplies and utilities. Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business. The complexities encountered in preparing the financial budget often require the preparation of detailed schedules.

Company

In almost all cases, operating income will be higher than net income because net income often deducts more expenses than operating income. For this reason, net income is often the last line reported on an income statement, while operating income is usually found a few lines above it. Operating income is the amount of income a company generates from its core operations, meaning it excludes any income and expenses not directly tied to the core business.

- If you have questions, you can consult usabout any part of your budgeted income statement.

- As a central planning tool, your management team will use this to direct business activities and judge the performance of the business in various areas.

- However, if you’re not sure how much money your business makes versus what costs are required to keep it running, you won’t be able to set an adequate operating budget.

- The calculation is similar to that used in the production budget, with the addition of the cost per unit.

- This is because if the budget is never exceeded, the numbers are clear.

Every finance department knows how tedious building a budget and forecast can be. Integrating cash flow forecasts with real-time data and up-to-date budgets is a powerful tool that makes forecasting cash easier, more efficient, and shifts the focus to cash analytics. It’s important to note that many companies track both operating profit and gross profit. For many startups, operating profit is of utmost importance as it is a key indicator of profitability. If you’re spending more money to operate your business than you’re bringing in, then you need to make a change to increase your operating profit. The EBIT-EPS analysis examines the effect different financing alternatives with various levels of EBIT have on Earnings Per Share .